8 Good Money Habits That Will Help You Secure Your Bag All 2021

In an effort to start January off right, I spoke with Gabrielle Oates from Smart Girl, Smart Money about good money habits to bring into the new year. Here are a few takeaways from that interview. For more good money habits and financial advice, tune into episode 10 of Beauty, Brains and Baggage.

1) Say no to Afterpay! Good Money Habits Require a Mindset Shift

Buy now, pay later programs are becoming increasingly popular. Most retailers offer an after pay option where consumers can opt to pay for an item in installments. Here’s the catch: these programs can’t help your credit but they can hurt your credit if you miss a payment. One of the easiest good money habits is learning how to tell yourself no.

“Those programs can’t do you any good but they can do you harm,” Oates said. “They’re not connected to your credit in the sense that they would benefit your credit but if you miss a payment, it would damage your credit so they’re dangerous in that way.

In an ideal world, we’d all keep track of our finances, noting down every withdrawal and deposit from our accounts. However, many people aren’t that meticulous, resulting in missed payments or an inability to earn the money back.

“To write down for the next four months I am going to have a $27 payment and to track that each month,” Oates said. “So many people slip up on that or, they think that they’ll earn it back but they never do, so they get that credit damage.”

As Oates noted in one of her Smart Girl, Smart Money posts, stop paying off the past. Pay in full upfront or not at all.

2) Start a Savings Account…and Actually Put Money Into It

Studies show that while 71% of Americans have a savings account, the vast majority have less than $1,000 saved. Only 15% of Americans have over $10,000 saved. Most Americans can’t handle an emergency requiring $400, let alone $1000.

Personally, I only had a debit account the past three years. With a debit account though, you can easily dip into your savings since you have your money in one place. A savings accounts makes it easier to save because you can’t touch that money once it’s transferred to that account. Unless you intentionally transfer it out.

Starting a savings account is “Good Money Habits 101.” Unfortunately, as noted above, many of us have savings account we don’t use. There are so many reasons why it’s hard to build wealth in America. The inability to build wealth most often isn’t a result of personal failings, but rather a system built on the cycle of poverty. So, don’t feel bad that it’s hard to save. However, working within the system we’re in, I’d advise you to try putting away money for a rainy day. Even if you end up saving $100 one month and $5 the next.

2020 showed us that having a $1000 saved won’t hold up in the face of actual crisis. While experts say that you should aim to have three to six months of expenses saved, even this is insufficient. Start small but the ultimate goal is having eight to twelve months of expenses stored away. For college students especially who may not have immediate expenses, start your savings account. Get into the habit of transferring at least a quarter of your monthly income into that account. Personally, I aim to transfer at least two of my paychecks monthly.

3) Start a Sinking Fund or Two

“[A sinking fund] is essentially having several savings accounts. So, for example, if you own a car, you can have a car repair sinking fund,” Oates said. “We know that cars eventually need repairs so let’s not treat it like an emergency and set aside money for that beforehand. Or, if you celebrate, Christmas you can have a Christmas sinking fund.”

Once you get into the habit of saving your money, starting with accruing that emergency savings fund, sinking funds are a great way to limit how much unexpected expenses can impact you. Better to be safe than sorry. One thing I can say for sure is I will DEFINITELY be starting a Christmas sinking fund this year.

4) Prioritize Paying Off Your Higher Interest Debt

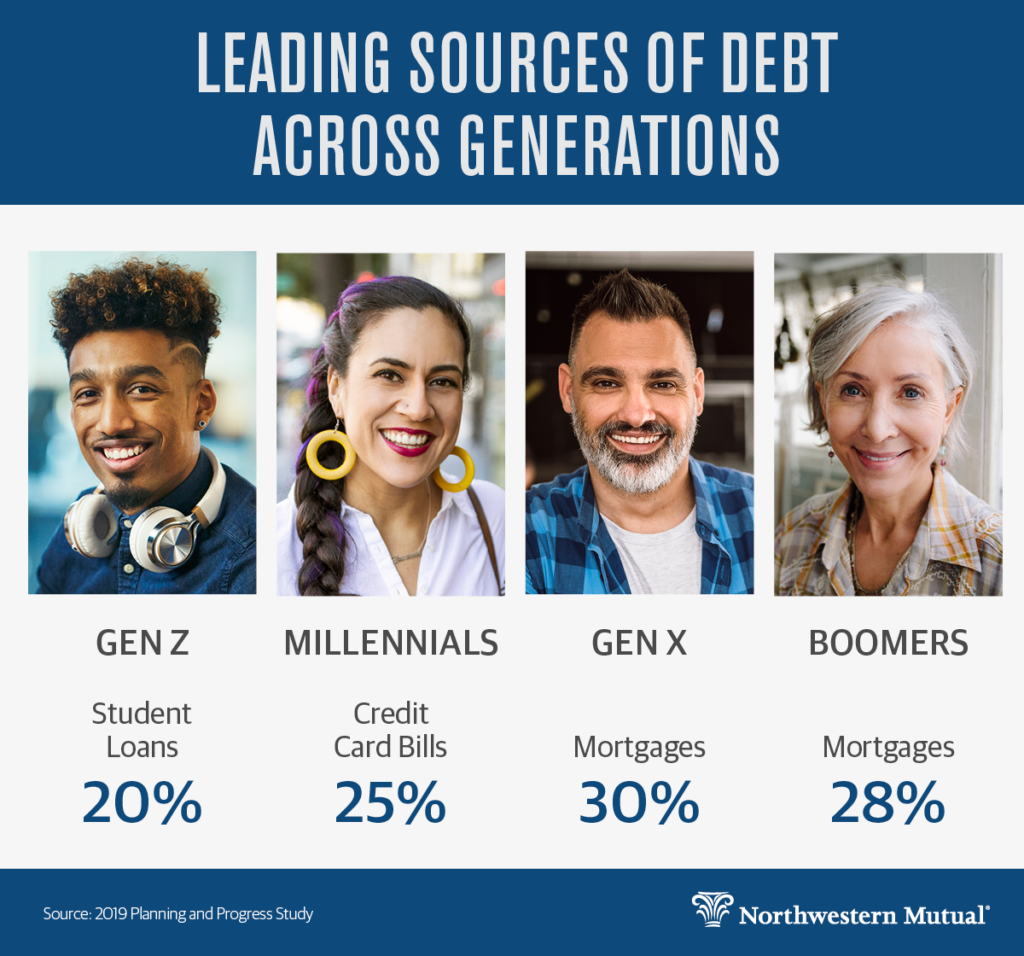

According to a Pew Research study, 80% of Americans are in debt. For Generation Z and Millenials most of our debt comes from student loans and credit card bills.

For Oates, her highest interest debt was her consumer (credit card) debt. If you have student loans AND credit card debt, it might be beneficial to pay off your credit card debt first. For Oates, her consumer debt, while not to the amount of her student loans, had an awfully high interest rate at 23%. So, had she not paid it off, she would’ve been stuck paying off debt that, while not as high as her student loans, would have accrued more interest later on.

She paid off her consumer debt using a balance transfer.

“I had a credit card with a high interest rate so I got a new credit card that had a 0% interest for a certain amount of months,” Oates said. “I then transferred my credit balance to that card so it would have 0% interest on how much debt I had. So I paid it off at 0% instead of 23%.”

If you’re struggling with credit card debt, this method could be helpful for you too. Take a look at your finances and see what debt needs to be paid off most immediately. Then tackle the longer term debt like student loans, car loans, and mortgages for example.

Debt with higher interest rates are hard to pay off because they add on a percentage of your debt to your principal each month and with a higher percentage comes a higher add on.

5) Pay Your Credit Card Off Monthly

Ever since I got a credit card my mother taught me to pay off my bill each month. The best way to avoid consumer card debt is to not accrue it in the first place. To do this, you should pay off your credit card statement balance in full each month.

Paying the minimum fee is tempting. But, continuously paying the minimum fee is a surefire way to accrue debt and deplete your ability to save. Whether you just paid off your consumer debt or you don’t have any to begin with, get in the habit of paying your full credit card bill.

A golden rule with credit cards is to make sure you’re only spending 30% of your limit. Remember, the money listed in your credit limit is not money you have. You are opting into paying back that money back if you choose to use your credit card. You don’t actually have $3000. Moreover, if you overspend and go over this limit you will have to pay back the $3000 and then some.

So, using the 30% rule, if you have a $3000 credit limit, you should aim to only spend $900. Or less if that’s not in your budget. The goal is to have no consumer debt and a credit score over 730. Doing this bare minimum tip can help you achieve both goals easily. Paying off your credit card on time will always be a good money habit. One of the best actually in my opinion.

6) Don’t be Afraid to Build Credit

With so many people in debt because of credit cards, it can be intimidating. However, all you have to do is use your credit card like you’d use your debit card. Buy your groceries with it. Pay for your gas. Spend the money you’d usually spend and pay the bill with the money you would’ve spent from your debit account.

Even if you only spend $100 each month on your little expenses, that is enough to manage your credit. Especially if you start off with a limit of $1500. The reality is, you need good credit and you can’t get good credit without building it in the first place. If you’re over the age of 18, get a credit card and spend wisely using the tips above.

7) Start Budgeting but Tailor Your Budget to Your Lifestyle

As noted above, it’s unrealistic to expect everyone to track every single expense. Budgeting with grouped expenses can help manage your money without becoming too tedious. Sit down and chart out your monthly expenses, creating an overall budget. Focus on the essentials. Chart out your expenses, a savings plan and a course of action for paying off any debt. Then you can (or not) add in any unnecessary expenses (i.e. takeout or shopping).

For college students, Oates advised starting to practice good money habits as soon as possible through earning and saving money.

“The key is to start flexing those [savings] muscles so when you do start earning full time income, you can resist the lifestyle inflation that comes with earning more money,” Oates said.

8) “Good Money Habits MVP”: Limit or Eliminate Your Retail Therapy

For those who don’t know, retail therapy consists of those non-essential expenses on clothes, skincare and all sorts of products. Americans engage in retail therapy for many reasons from needing a self esteem boost to craving a sense of control. In total, retail therapy costs the average American $1600 each year. In 2020 terms, that’s a whole stimulus check.

Lucky for us, we have to stay in the house this year. Use the beginning of 2021 to keep telling yourself no when it comes to those non essential expenses. Establishing good money habits isn’t always easy. It requires discipline, sacrifice and perspective. Instead of craving temporary gratification, look forward to long term security and comfort.

Pay yourself before you pay anyone else

The biggest takeaway is to take your financial wellness seriously. We work so hard to earn our money, we deserve to be able to save some of it for ourselves. I love thinking of it as paying myself because it reminds me to prioritize my savings goals and wellbeing. For example, as soon as I get paid, I transfer as much of my paycheck as possible to my savings. If your weekly paycheck is $400, after everything is paid, pay yourself. Whether it’s a $1 or a $100, make your money work for you.

To hear more good money habits and tips, check out the latest episode of Beauty, Brains and Baggage, “Unpacking: Financial Wellness” featuring Smart Girl, Smart Money.